VIX3M: Unveiling Mid-Term Market Volatility

What is the VIX3M?

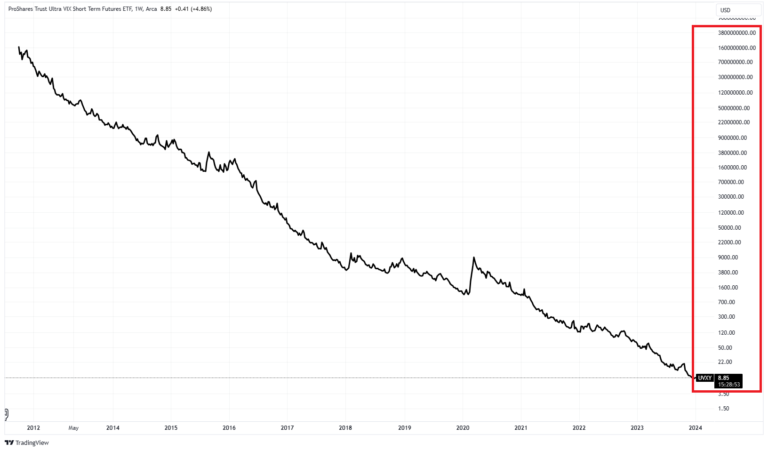

In the ever-evolving landscape of financial markets, understanding the intricacies of volatility is often the key to success. Enter the VIX3M, or CBOE 3-Month Volatility Index, a metric designed to provide valuable insights into the medium-term expectations of market volatility. While its renowned cousin, the VIX, offers a 30-day projection, the VIX3M extends its gaze to a more nuanced 3-month horizon.

The VIX3M, or CBOE Volatility Index with a 3-month maturity, measures expected market volatility over a three-month period and is often referred to as the “three-month VIX.”

Crafted from a mosaic of options on the S&P 500 index, the VIX3M offers a unique perspective on market sentiment, helping investors and traders decipher the medium-term volatility landscape. Think of it as a finely-tuned instrument that detects the ripples before the waves, granting a glimpse into the future that stretches beyond the immediate.

What is the Difference between VIX3M and VIX?

Distinguishing between the VIX3M and its shorter-term sibling, the VIX, is crucial for navigating the intricate terrain of market volatility. The primary disparity lies in the temporal focus.

The main difference between VIX3M and VIX is the time horizon they measure. VIX3M focuses on expected market volatility over a three-month period, while VIX represents expected volatility over a 30-day period.

This difference in timeframes profoundly influences their responsiveness to market shifts. The VIX3M moves with grace, capturing the medium-term fluctuations in market expectations, while the VIX operates with the swiftness of a short-term sprinter. It’s like comparing the rhythm of a waltz to the tempo of a quickstep in the world of market metrics.

How to Interpret the VIX3M?

Unlocking the secrets of the VIX3M demands a discerning eye for its oscillations. When the VIX3M ascends, it signifies a heightened expectation of medium-term volatility, suggesting potential turbulence on the horizon. Conversely, a descending VIX3M signals waning medium-term volatility expectations, painting a picture of a calmer market landscape in the months ahead.

For traders and investors, the VIX3M operates as a periscope, providing an advanced view of medium-term market sentiment. A thoughtful analysis of its movements can serve as a North Star for strategic decisions, guiding individuals in assessing the evolving market conditions.

How to Analyze the VIX3M?

Analyzing the VIX3M is a multidimensional endeavor that often entails a blend of technical and fundamental approaches. Traders may delve into historical data, chart patterns, and technical indicators to discern potential turning points and opportunities in the medium-term volatility landscape.

Furthermore, staying attuned to economic events, geopolitical developments, and central bank policies is paramount, as these factors can significantly impact medium-term market sentiment. The synergy of technical and fundamental analysis provides a holistic view, equipping traders and investors with a robust toolkit for interpreting and harnessing the VIX3M’s insights.

What is the Correlation between VIX3M and VIX?

The correlation between the VIX3M and its shorter-term counterpart, the VIX, is a captivating aspect of the volatility universe. Although they share a common mission, their distinct timeframes introduce a compelling dynamic. Generally, the VIX3M takes the lead, often foreshadowing movements in the VIX with a slight temporal lag.

This correlation can be a valuable ally for traders, offering a glimpse into the broader volatility landscape. It’s like having both a short-term and medium-term forecast in one’s arsenal, aiding in strategic decision-making and providing a nuanced understanding of market sentiment.

How to Find Trading Opportunities with the VIX3M?

Unearthing trading opportunities within the realm of the VIX3M requires finesse and expertise. Traders often integrate the VIX3M with other technical indicators and chart patterns to identify potential entry and exit points in the medium-term volatility landscape.

Additionally, staying informed about economic data releases, corporate earnings reports, and geopolitical shifts is essential, as these factors can substantially influence medium-term market sentiment. By combining technical and fundamental analyses, traders can navigate the nuanced terrain of the VIX3M with precision, seizing opportunities as they arise.

How to Use the VIX3M for Risk Management?

The VIX3M plays a pivotal role in risk management strategies, providing a unique vantage point for assessing medium-term market sentiment. Investors can employ it as a compass to gauge the potential for market turbulence in the coming months, allowing them to adjust portfolio allocations accordingly.

When the VIX3M indicates heightened medium-term volatility expectations, a more conservative stance, such as reducing exposure to higher-risk assets, may be advisable. Conversely, when the VIX3M suggests declining medium-term volatility, investors might consider selectively increasing exposure to riskier assets. It’s a tool that helps navigate the financial seas with a steady hand, allowing investors to make informed decisions to mitigate risk or capitalize on opportunities.

Conclusion

In the intricate tapestry of financial markets, the VIX3M emerges as a valuable thread, weaving together insights into medium-term volatility expectations. Whether you are a seasoned trader or an investor seeking to make informed decisions, understanding the nuances of the VIX3M can be the key to unlocking opportunities and managing risk in the dynamic world of finance. As you embark on your journey to harness the power of the VIX3M, remember that knowledge is the compass that leads to financial success in the ever-evolving landscape of financial markets.