Actually Useful AI Prompts for Traders

Actually Useful AI Prompts for Traders In today’s fast-paced financial markets, traders must sift through an overwhelming amount of data and make rapid decisions. Artificial intelligence (AI) has emerged as a powerful ally, and with the right prompts, traders can harness tools like ChatGPT to streamline analysis, refine strategies, and boost overall productivity. In this…

How to Land a Trading Job: A Guide for Aspiring Traders

Breaking into the trading world can feel daunting, especially if you’re aiming for a role with a proprietary trading firm or applying for a position as a trader in general. However, with the right approach, preparation, and mindset, you can set yourself apart from the crowd. This guide covers two main paths: applying for a…

FTMO’s U.S. Ban: What It Means for Traders and the Future of Prop Trading

The trading world was shaken recently by big news: FTMO, one of the largest and most respected proprietary trading firms, has announced it will no longer accept new traders from the United States. Existing U.S. clients will also lose the ability to purchase challenges. This marks a significant shift for FTMO and raises important questions…

Futures vs. CFD Prop Trading Firms

Futures vs. CFD Prop Trading Firms: Which One is Right for You? If you’re diving into the world of prop trading, you’ve probably come across two big players: Futures Prop Trading Firms and CFD Prop Trading Firms. And if you’ve wondered what the difference is—or which one might work best for you—you’re not alone. Let’s…

How Much Money Do You Really Need to Trade the Forex Market?

How Much Money Do You Really Need to Trade the Forex Market? One of the most common questions aspiring traders ask is, “How much money do I need to trade in the Forex market?” With the proliferation of online brokers and marketing strategies promising to let you start trading with as little as $100, it’s…

Best Broker Backed Prop Firm Space: What You Need to Know

The 4 Best Broker Backed Prop Firm Space: What You Need to Know A number of brokers have ventured into the proprietary trading (prop firm) space. While brokers are the middlemen facilitating trades between retail traders and the markets, prop firms allow traders to use firm capital to trade without risking their own money. But…

3 Key Strategies to Improve Your Trading Performance

3 Key Strategies to Improve Your Trading Performance Traders are constantly on the hunt for the “Holy Grail” – a system that guarantees profitability. While some argue that every strategy works, others remain skeptical. Regardless of where you stand, the truth is that success in trading comes from focusing on certain core principles. In this…

What is Prop Firm Trading

What is Prop Firm Trading In recent years, prop firm trading has gained considerable attention in the financial markets. This article will break down what prop firm trading is, its pros and cons, and whether you should consider trading your own money or exploring a career as a prop firm trader. What is Prop Firm…

Should You Trade Your Own Money or Use a Prop Firm?

Should You Trade Your Own Money or Use a Prop Firm? Over the last few years, the prop firm industry has seen meteoric growth, especially within the retail trading space. But what exactly is a prop firm, and more importantly, should you consider using one, or are you better off trading your own account? What…

How Prop Firms Make Money

How Prop Firms Make Money Prop trading firms, or proprietary trading firms, have become increasingly popular as more traders seek opportunities to trade with large amounts of capital. However, the way these firms make money can vary significantly depending on their business model. In general, modern prop firms profit by selling challenges to aspiring traders…

Step by Step Guide to Becoming a Profitable Trader

Step by Step Guide to Becoming a Profitable Trader and Earning Over $200,000 in the Markets In this article, I’m going to walk you through the exact Step-by-Step progress that took me from zero to profiting over $200,000 in the markets. This blueprint is for the 90% of traders who are striving for profitability but…

Best Prop Firms for Swing Traders

Best Prop Firms for Swing Traders Swing trading, characterized by holding positions over several days to weeks, demands specific conditions that many day-trading-focused prop firms may not provide. This article provides a detailed overview of prop firms that cater best to swing traders, listing their fees, requirements, conditions, and other crucial details. Each firm is…

How Long Does It Take to Finish the First Phase of a Prop Firm Challenge?

How Long Does It Take to Finish the First Phase of a Prop Firm Challenge? For many traders, just like me, joining a proprietary (prop) trading firm is an exciting opportunity to trade larger capital with the firm’s backing, often after passing a two-phase challenge. A common question among those considering this path is: “How…

How to Set Realistic Goals for Your FTMO Challenge

How to Set Realistic Goals for Your FTMO Challenge The FTMO Challenge is a unique opportunity for traders to prove their skills and gain access to a funded trading account. It’s a popular avenue for those who want to trade with significant capital without risking their own money. However, passing the FTMO Challenge is not…

7 Reasons to Choose Swing Trading Over Day Trading/Scalping in Prop Trading Like FTMO

7 Reasons to Choose Swing Trading Over Day Trading/Scalping in Prop Trading Like FTMO Swing trading and day trading/scalping are two popular strategies among traders, especially in the prop trading environment provided by firms like FTMO. While both have their merits, swing trading offers several advantages that make it a more sustainable and potentially more…

When a Trader Should Start Trading at a Prop Firm

When a Trader Should Start Trading at a Prop Firm Proprietary trading firms, commonly known as “prop firms,” have emerged as an attractive option for traders looking to leverage more capital without risking their own. In this article, we will delve into the critical question: “When should a trader start trading at a prop firm?”…

The Ultimate Guide to Passing the FTMO Challenge: Strategies, Tips, and Tricks for Success

The Ultimate Guide to Passing the FTMO Challenge: Strategies, Tips, and Tricks for Success is an essential resource for traders seeking funding from FTMO. This guide emphasizes the importance of discipline, risk management, and consistency in navigating the rigorous evaluation process. With practical strategies for meeting the challenge’s strict rules, as well as common pitfalls to avoid, this comprehensive overview equips traders with the knowledge needed to successfully secure a funded trading account.

Risks of Prop Trading: What Every Trader Needs to Know

Risks of Prop Trading: What Every Trader Needs to Know Proprietary trading (prop trading) has surged in popularity, offering traders the opportunity to trade with significant capital, far beyond their own means. However, this opportunity comes with its own set of risks. For anyone considering a venture into prop trading, it’s essential to understand these…

How Much Money Do Prop Traders Actually Make?

How Much Money Do Prop Traders Actually Make? Proprietary trading, often referred to as “prop trading,” is a field shrouded in mystery for many, especially when it comes to understanding the potential earnings. Unlike typical traders, who manage their own or clients’ capital, prop traders are employed by firms that provide them with capital to…

How to Get a Discount for the FTMO Challenge

How to Get a Discount for the FTMO Challenge The FTMO Challenge is an opportunity for aspiring traders to prove their skills and gain access to funded trading accounts. However, the challenge fee can be a hurdle for many. Fortunately, there are several ways to secure discounts on the FTMO Challenge fees. Here’s how you…

Qualities a Trader Should Have for the FTMO Challenge

Qualities a Trader Should Have for the FTMO Challenge The FTMO Challenge is a popular opportunity for traders to prove their skills and secure funding for their trading activities. However, passing the challenge requires more than just technical knowledge of trading; it demands a specific set of qualities that can significantly increase the likelihood of…

Do Prop Firms Actually Pay Out?

Do Prop Firms Actually Pay Out? Prop trading firms, or proprietary trading firms, have surged in popularity in recent years as a means for aspiring traders to access significant capital without risking their own money. These firms offer traders the chance to earn a profit split by trading on their capital after passing a series…

The Reasons Why Most Traders Fail a Prop Trading Challenge

The Reasons Why Most Traders Fail a Prop Trading Challenge Prop trading firms have become a popular way for aspiring traders to access significant capital without risking their own money. With the allure of funded accounts and profit-sharing, many traders are eager to take on the challenges offered by these firms. However, while the concept…

Why Passing a Prop Firm Challenge is Easy, But Getting Paid is So Hard

Why Passing a Prop Firm Challenge is Easy, But Getting Paid is So Hard In the world of trading, prop firms offer an enticing proposition: pass a challenge, prove your trading skills, and get access to significant capital to trade with. On the surface, the idea seems like a shortcut to financial success. However, while…

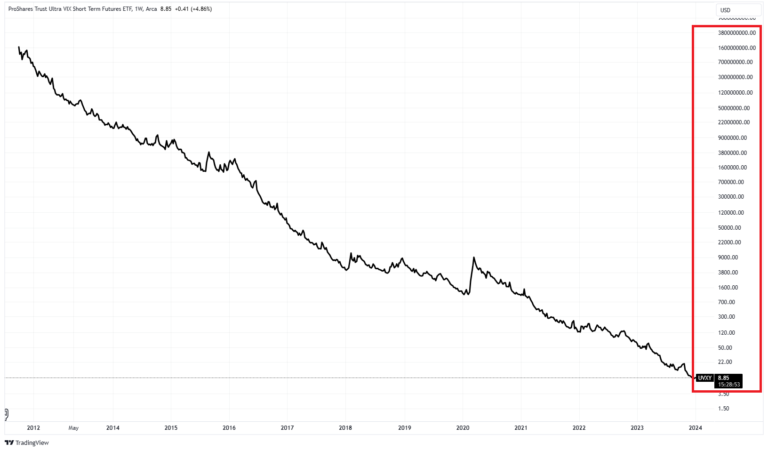

Is SVIX a Good Buy for Roth IRAs?

This article is about the volaility product SVIX and it’s use for Roth IRAs.

Stock Market Crash History and the key takeaways

This article explores the history of stock market crashes, delving into their causes, impacts, and the most significant crashes in history, such as the 1929 Wall Street Crash and the 2008 Financial Crisis. It also answers key questions about how often the market has collapsed, the average drop during crashes, and what recovery looks like for investors.

6 Reasons Selling UVXY Calls Is Not Worth the Risk

6 Reasons Selling UVXY Calls Is Not Worth the Risk In the world of trading and investing, UVXY (ProShares Ultra VIX Short-Term Futures ETF) is known for its high volatility and complex behavior. Selling UVXY call options can appear enticing due to the potential for collecting premiums, but it comes with significant risks and drawbacks….

UVXY Correlation to the Spot VIX as Well as to Peer ETPs

This article examines the correlation between the ProShares Ultra VIX Short-Term Futures ETF (UVXY) and the Spot VIX, revealing a strong positive correlation of 0.87 on average. UVXY responds significantly to volatility spikes but can experience decay in stable periods, making it a suitable short-term hedge rather than a long-term investment.

Current UVXY Borrow Rate and why it matters

This article discusses the UVXY borrow rate, a critical factor in short selling UVXY ETF shares. It explains how market demand, share availability, and economic conditions affect this rate, impacting trading strategies and trader profitability, especially in volatile markets, emphasizing its importance for both traders and investors.

Market Conditions and UVXY Performance

How market conditions influence UVXY performance. Learn when UVXY thrives and when to avoid trading this leveraged volatility ETF.

UVXY vs VXX: A Comprehensive Comparison

Discover the differences between UVXY and VXX, two popular volatility ETFs. Understand their structure, performance, and suitability for your investment strategy.

Risks of UVXY

Discover the hidden risks of UVXY, an ETF that tracks volatility. Learn about the potential dangers, strategies to mitigate them, and how to invest wisely.

The Appeal of UVXY

“This article shows how traders can use UVXY’s leverage, which amplifies gains by 1.5 times the daily performance of the S&P 500 VIX Short-Term Futures Index, as a potent tool for profiting from market volatility. By navigating these fluctuations adeptly, traders can capitalize on UVXY’s dynamics to achieve rapid returns during periods of economic uncertainty or geopolitical turmoil.”

Wikifolio Review. Pros and Cons of using wikifolio.

Wikifolio Review: The Best Social Trading Platform As an experienced Wikifolio trader with an investable Wikifolio named “Relative Rendite US500” boasting over 25% p.a. return, I know what I’m talking about. Wikifolio stands out in the crowded world of social trading platforms. It provides a unique opportunity for investors to build a verifiable track record…

How does wikifolio work? A step-by-step guide for investors and traders.

Discover how Wikifolio works with this comprehensive step-by-step guide, perfect for both investors and traders seeking to understand the platform’s functionality and unlock its potential.

What is wikifolio

Learn what Wikifolio is, how it works, and why it’s a revolutionary platform for traders and investors. Discover its features, benefits, and user insights.

Volatility Calculator – Calculate the expected move of any underlying

Volatility Calculator – Calculate the expected move of any underlying (S&P 500, NASDAQ 100, VIX, SPY, QQQ, IWM). Most usefull for option trading, selling puts, iron condor

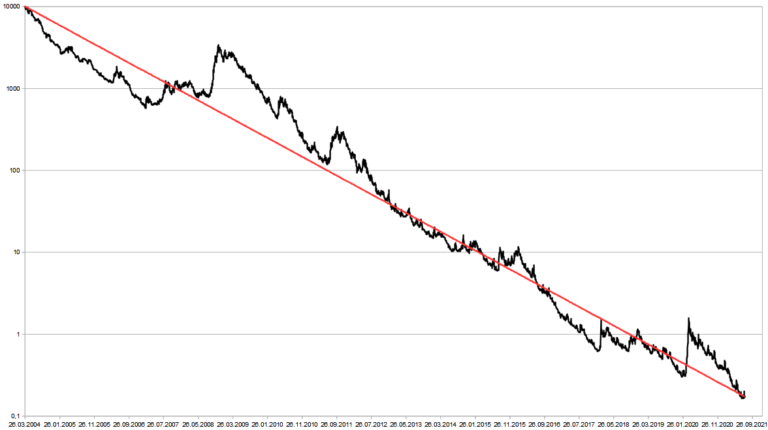

UVXY Reverse Splits

This article is about UVXY Reverse Splits and the most important things a trader and investor has to know about them.

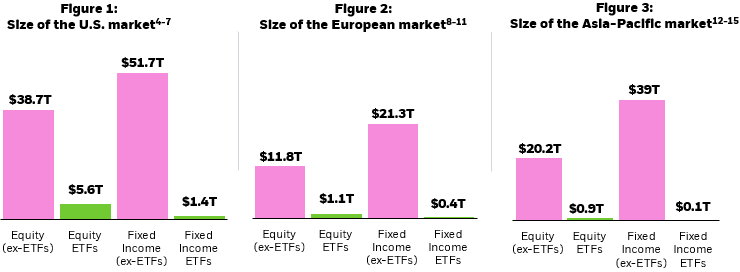

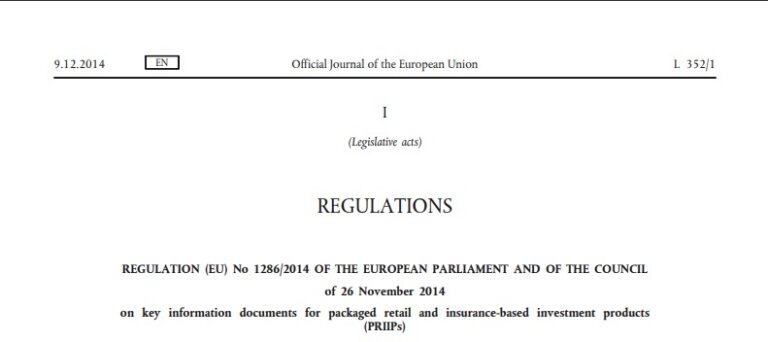

Comparison of European vs US ETFs

US ETFs vs their European Counterparts Exchange-Traded Funds (ETFs) are powerful investment vehicles. This article aims to unravel the intricate dynamics surrounding ETFs, shedding light on their growing popularity in both European and US markets. In this article i show you how to buy US ETFs as a european. Understanding European ETFs Definition and characteristics…

ETF Market Statistics: A Interesting Overview

ETF Market Statistic The global financial landscape is evolving, and Exchange Traded Funds (ETFs) play a significant role in this transformation. This blog post examines key statistics shaping the ETF market, including market size by region, trading volumes, and the growing influence of ETF options. ETF Market Size: Still just a Fraction of the Global…

Panic Sign: Put/Call Ratio

Panic Sign: Put/Call Ratio In this installment of the Panic Signs series, we delve into the fascinating world of the Put-Call Ratio (PCR). Often glanced at by traders, the Put-Call Ratio is more significant than meets the eye. However, few really understand how to use the PCR to their advantage. While I don’t claim to…

Panic Sign: 3 Point VIX Reversal

Panic Sign: 3 Point VIX Reversal In this article we will focus on the third panic sign, the “3 Point VIX Reversal”. This is my favorite of the 5 panic signs because the reversal often signals the unwinding of hedges by major players, providing astute traders with valuable insight into the underlying market dynamics. It…

Panic Sign: VVIX

Today, we embark on an exploration of the second panic point, illuminating the fascinating world of volatility embodied by the VVIX index. Created by the Chicago Board Options Exchange (CBOE), the VVIX is the focus of our journey. This synthetic index provides a snapshot of market fear and volatility, offering a unique perspective on the…

Panic Sign: 90% Down Days

Today, we once again delve into the world of panic signals. Our focus today is on the first panic signal – the 90% down days. But before we dive into the details, let’s clarify what downward pressure actually means and how we can comprehend it. In the New York Stock Exchange, thousands of stocks are…

Panic Signs at Market Bottoms

Panic Signs at Market Bottoms From time to time we see dramatic price drops, the recent market drop in 2022 comes to mind. Every trader wants to time the bottom of the market and live the dream of buying low and selling high. But the reality is that it is very difficult to time the…

Understanding UVXY Decay: How Long-Term Holding Affects Performance and Risk

This article analyzes the decay rate of the ProShares Ultra VIX Short-Term Futures ETF (UVXY), highlighting how its performance deteriorates over time due to factors like daily rebalancing and contango. It provides insights into the risks of holding UVXY long-term and offers strategies for mitigating potential losses.

HOW TO BUY U.S. ETFS FROM INDIA?

HOW TO BUY U.S. ETFS FROM INDIA? In many countries, buying US-domiciled exchange traded funds (ETFS) is very difficult or seemingly impossible. Are you also wondering how to buy US ETFS from India? Like you, i have been looking to spend some money on US financial Instruments. Based on my findings, i have put together…

Maximise Profit, Minimise Risk with Stock Replacement

Stock Replacement Stock Replacement is a method of using “in the money” Put or Call Options to mimic the directional exposure of a stock or ETF without holding the stock or ETF directly. Most traders are using stocks or ETFs for their investments. However the replacement through options can be prefered for those who aren´t…

VOLI

Unlocking the secrets of the VOLI Index In the ever-evolving world of finance, investors are constantly on the lookout for tools that can give them a competitive edge. One such tool that has gained attention in recent years is the VOLI index, a hidden gem that, if understood and used correctly, can open doors to…

Volatility Targeting

Navigate Market Cycles with Volatility Targeting Volatility has two essential characteristics. First, volatility is cyclical, and second, it is constant. This apparent contradiction can be resolved by considering the element of time. Over short periods of time, volatility tends to continue the behavior of the recent past, maintaining the current level. High volatility begets high…

NIFVIX

Profit with VIX India I often use the VIX India to navigate the unpredictable waters of the stock market. Have you ever wondered how this powerful tool could potentially change your financial strategies? Dive into this blog post to discover hidden gems of knowledge that can help you make smart investment decisions, manage risk, and…

VIX1D

VIX1D Revealed: Mastering Short-Term Volatility What is the VIX1D? The VIX1D, often referred to as the “1-Day Volatility Index,” is a key indicator in the world of finance, specifically designed to measure short-term volatility expectations in the financial markets. It provides traders and investors with insights into anticipated price fluctuations over a brief one-day period….

VIX1Y

Navigating Long-Term Volatility Swings with VIX1Y In a world where markets ebb and flow like tides, harnessing the power of VIX1Y could be your key to confidently sailing through the unpredictable waters of investment. Dive into this knowledge reservoir, and you might find yourself steering toward a future where financial gains become more than just…

VIX6M

Mid-Term Volatility Mastery with VIX6M What is the VIX6M? In the ever-evolving landscape of financial markets, mastering volatility is often the cornerstone of successful trading and investment strategies. Enter the VIX6M, or CBOE 6-Month Volatility Index, a potent metric that provides a window into market expectations for medium-term volatility. While its sibling, the VIX, gazes…

VIX3M

VIX3M: Unveiling Mid-Term Market Volatility What is the VIX3M? In the ever-evolving landscape of financial markets, understanding the intricacies of volatility is often the key to success. Enter the VIX3M, or CBOE 3-Month Volatility Index, a metric designed to provide valuable insights into the medium-term expectations of market volatility. While its renowned cousin, the VIX,…

VIX Cash Term Structure

From Fear to Fortune: How the VIX Term Structure Predicts Market Crashes I present to you a comprehensive examination of the VIX Cash Term Structure, an indispensable tool for savvy investors seeking a financial edge. In the dynamic realm of financial markets, having the right information at the right time is often the key to…

VIX9D

VIX9D: Your Guide to Short-Term Volatility In the realm of financial markets, where unpredictability is the name of the game, having the right tools to navigate the turbulence is essential. One such tool that has been quietly making waves is the VIX9D, a lesser-known cousin of the more famous VIX (CBOE Volatility Index). In this…

The 3 Best Options Trading Books for Beginners

Unlocking Options Trading Secrets: Best 3 Books for Beginners Exploring new trading opportunities is important for your journey as a beginner. At the start, you may not know what strategies work best for you and what instruments fit your style best. Books can help you find your way and meet your goals. In this list,…

Skyrocketing VIX: Where is the ceiling?

How High Can The VIX Go? In the last marketcrash during march 2020 i asked myself how high can the VIX go? The VIX nearly trippeld from the lows to 50 and the S&P 500 already dropped 20%. I saw that fear and panic pushed stocks down and the vix up but i did not…

Can VIX be negative

No Negativity Allowed: Why the VIX Stays Out of Negative Territory In the world of finance, few indicators are as closely watched as the VIX, or volatility index. It’s often referred to as the “fear gauge” of Wall Street, providing invaluable insight into investors’ future expectations and sentiment. But can the VIX be negative? In…

Why is there no ETF that directly tracks the VIX index?

Why is there no ETF that directly tracks the VIX index? As I explained my trading strategy to a friend of mine, he asked, “Why do you trade the VIX Futures? Is there no ETF that directly tracks the VIX index?” Because of that, I realized that many new traders may come across the VIX…

VVIX Demystified: Navigating the Volatile Terrain

VVIX Demystified: Navigating the Volatile Terrain In today’s ever-evolving financial landscape, it’s crucial to grasp the intricacies of indicators that can potentially unlock opportunities for savvy investors. One such indicator that holds the key to understanding market dynamics is the VVIX. Have you ever wondered how this enigmatic sibling of VIX, the fear gauge, could…

“When the VIX is low, it’s time to go.”

“When the VIX is low, it’s time to go” “When the VIX is low, it’s time to go.” After the 2020 stock market crash, triggered by government action to fight a pandemic, and the 2022 bear market, the VIX volatility index fell sharply from elevated levels. Now that the VIX is low, this stock market…

How to Buy US ETFs in Europe (2024)

Buying US based Exhange Traded Funds (ETFs) from outside of America can be difficult. Are you also wondering how to buy US ETFs from Europe or the United Kingdom?

In this article i will show you five ways that Europeans can use to get exposure to US ETFs.

Understanding Relative Return: A Comprehensive Guide

Understanding Relative Return: A Comprehensive Guide In this article, we delve into the concept of relative return, explaining what it is, how it’s calculated, and why it’s a crucial metric in investment analysis. What is Relative Return? Relative return is the return generated by an asset over a period of time compared to a benchmark….

List of all Volatility Indices

The Complete List of Volatility Indices In the world of finance, there is no one-size-fits-all approach. Different sectors, geographic regions and asset classes have unique characteristics. A complete list of volatility indexes takes this diversity into account, allowing investors and traders alike to tailor their strategies to specific market segments. Whether you’re interested in technology…

VIX: A Beginner’s Guide

VIX: A Beginner’s Guide The world of finance and investing is full of jargon and complex indicators. One such indicator that often makes headlines is the VIX, also known as the “Fear Gauge” or “Volatility Index.” For beginners looking to dive into the world of investing, understanding the VIX is a crucial step. In this…

Seasonal Patterns in the VIX: Fact or Fiction?

Seasonal Patterns in the VIX: Fact or Fiction? The idea of seasonality suggests that the VIX follows a predictable pattern at certain times of the year. Some studies suggest that the VIX rises in summer and early fall, with major seasonal lows in July and major highs in October. This pattern is often attributed to various…