From Fear to Fortune: How the VIX Term Structure Predicts Market Crashes

I present to you a comprehensive examination of the VIX Cash Term Structure, an indispensable tool for savvy investors seeking a financial edge. In the dynamic realm of financial markets, having the right information at the right time is often the key to staying ahead. Enter the VIX Cash Term Structure, a multi-faceted indicator that provides early warnings of potential market crashes.

In this in-depth guide, we will delve into the intricacies of this financial instrument, unraveling its components and uncovering its multifaceted utility. Whether you’re a seasoned investor or just beginning your financial journey, understanding the VIX Cash Term Structure could be the key to unlocking your financial aspirations.

What is the VIX Term Structure?

How the VIX and Its Additions Reflect Market Sentiment

Understanding how the VIX and its supplements – VIX1D, VIX9D, VIX3M, VIX6M, and VIX1Y – reflect market sentiment is paramount to navigating the labyrinthine world of financial markets. These indicators serve as the heartbeat of the market, capturing the collective emotions and expectations of investors. VIX1D and VIX9D provide insight into short-term sentiment, reflecting traders’ immediate fears and uncertainties.

In contrast, the VIX3M, VIX6M, and VIX1Y provide a broader perspective, encompassing the medium- to long-term outlook. When these indicators rise, it indicates heightened fear and uncertainty among investors, suggesting potential market turbulence or even crashes. Conversely, lower readings signal confidence and calm. By monitoring these indicators together, investors can gauge the pulsing rhythm of market sentiment, enabling them to make informed decisions and anticipate market dynamics.

Defining VIX Cash Term Structure

The VIX Cash Term Structure, an amalgamation of the VIX1D, VIX9D, VIX, VIX3M, VIX6M, and VIX1Y, encapsulates expected market volatility over varying time horizons. Unlike the standard VIX, which provides a single measure of implied volatility for the coming month, the VIX Cash Term Structure provides a panoramic view of market sentiment. This multi-faceted approach provides insight into expected volatility levels for various future periods.

The configuration of this curve is critical to deciphering the market’s collective perspective and can provide invaluable insight into potential market crashes. By examining how the curve evolves over time, investors can gain a deep understanding of market dynamics and make informed decisions to protect their investments or take advantage of opportunities in a volatile financial environment.

How does the VIX Cash Term Strucuture differ from the VIX Future Term Structure?

The VIX Cash Term Structure, often referred to as the Spot VIX Curve, is a representation of expected volatility levels in the options market over various time frames. It is composed of several VIX indices, including the VIX1D (1-day volatility), VIX9D (9-day volatility), VIX3M (3-month volatility), VIX6M (6-month volatility), and VIX1Y (1-year volatility). Each of these indices captures the implied volatility of S&P 500 options with different expiration dates. The VIX1D and VIX9D provide insight into short-term sentiment, reflecting traders’ immediate fears and uncertainties, while the VIX3M, VIX6M, and VIX1Y provide a broader perspective, encompassing medium- to long-term outlooks. This structure provides a snapshot of market sentiment at any given time, helping investors gauge the current level of market fear or complacency.

On the other hand, the VIX futures term structure is derived from the prices of VIX futures contracts. These contracts represent the market’s expectations of future volatility levels and span various future time frames. Unlike the VIX Cash Term Structure, which reflects the present, the VIX Future Term Structure provides insight into expected volatility over time horizons ranging from one month to several years. It is a forward-looking indicator that provides investors with information on how the market expects volatility to evolve in the future.

In summary, while both structures provide valuable information about market volatility, the VIX Cash Term structure focuses on current sentiment and serves as a reflection of the market’s collective emotions in the here and now. In contrast, the VIX Future Term Structure looks forward, projecting expected volatility levels over various future time periods. Understanding the differences between these two structures can help investors make informed decisions based on their specific needs and investment horizons.

What is the Term Structure of Volatility?

The term structure of volatility is a multifaceted concept in finance that provides a nuanced understanding of market sentiment and risk expectations over various time frames. It can be defined and examined through two primary lenses: the VIX Cash Term Structure and the VIX Future Term Structure.

First, the VIX Cash Term Structure serves as a dynamic barometer of expected market volatility. Derived from options on the S&P 500 Index, it represents the collective consensus of market participants regarding implied volatility for various future expiration dates. This curve is like the heartbeat of the financial marketplace, pulsing with information about short- and long-term volatility expectations. For investors and traders, it provides real-time insight into current market sentiment, enabling them to assess risk and make strategic decisions accordingly.

Second, the VIX Future Term Structure broadens the perspective by including futures contracts based on the VIX index. This curve extends the analysis beyond the immediate future by illustrating expected volatility levels for different expiration months of VIX futures. In doing so, it captures market sentiment over a broader time horizon, from short-term fluctuations to longer-term trends. Investors often turn to this curve to gain a comprehensive view of volatility expectations, helping them navigate market dynamics and align their positions with their risk tolerance and investment objectives.

How to Use the VIX Cash Term Structure Effectively?

Interpreting the Shape of the Curve

Mastering the interpretation of the shape of the VIX Cash Term Structure curve is an art honed by sophisticated investors seeking to decipher the intricacies of market sentiment. The curve, the result of plotting the implied volatility levels of various VIX futures contracts, can take on several shapes, each loaded with its own meaning. When the curve slopes upward, with the VIX1D lower than the VIX9D and every other VIX calculation (3M, 6M, 1Y), it indicates a market in which short-term uncertainty is comparatively muted compared to long-term fears, often referred to as “contango”. This shape suggests that the market’s immediate fears have been assuaged, but concerns about the future remain, which is almost always the case.

In contrast, a descending slope, where the VIX1D exceeds the VIX9D, indicates backwardation. This configuration suggests that immediate volatility is expected to exceed volatility in the distant future, indicating an immediate sense of unease among market participants. An inverted curve can foreshadow potential market turbulence as investors brace for short-term disruptions.

The stability of the VIX indicator increases as the options used in its calculation move further away from their expiration dates. Specifically, the VIX1Y shows slower movement compared to the VIX3M and VIX1D. It’s the different characteristics of these different VIX calculations that make tools like the VIX Cash Term Structure valuable to investors.

Excluding certain durations from your market analysis can be a strategic move. Short-term traders may prefer to focus primarily on the VIX1D, VIX9D, and VIX, while longer-term investors may choose to ignore them entirely and focus solely on long-term trends. For example, I personally exclude the VIX1D and VIX1Y from my analysis and place less importance on the VIX6M.

Interpreting the dynamics of these curves and their implications is akin to deciphering the collective psyche of the market. Investors who can effectively decode these shapes will gain an edge in anticipating market movements.

Identifying Patterns and Anomalies

Identifying patterns and anomalies within the VIX Cash Term Structure is akin to deciphering the fine print of market sentiment. Seasoned investors and analysts meticulously scrutinize this intricate curve for subtle clues and early warnings, especially during market crashes.

A common pattern to watch for is the abrupt steepening of the curve, where the short-term VIX1D and VIX9D readings spike significantly in contrast to the longer-term VIX3M, VIX6M, and VIX1Y. This divergence can signal a sudden increase in immediate market fear and uncertainty, which can precede a rapid market downturn.

Conversely, a significant upward shift in the overall curve often indicates an extended period of heightened market volatility across all time frames. This pattern could foreshadow a prolonged period of turbulence or a sustained market downturn.

Anomalies, on the other hand, are deviations from the expected curve patterns. For example, if the curve remains flat or inverted for an extended period of time, it may signal ongoing market stress that could lead to a significant correction or crash.

Examining historical data, including past market crashes, provides a wealth of insight into these patterns and anomalies. By contrasting the behavior of the VIX Cash Term Structure before and during previous market crashes, investors can identify early warning signs and strategically position themselves to protect their portfolios or take advantage of opportunities as market dynamics shift.

Real-World Examples of the VIX Cash Term Structure before Market Crashes

Examining Past Market Crashes

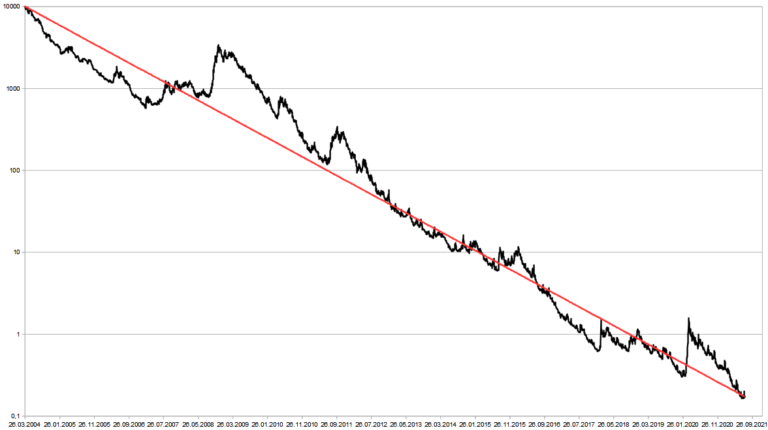

Analyzing past market crashes through the prism of the VIX Cash Term Structure provides invaluable insight into how this indicator has served as a harbinger of impending financial turmoil. Throughout history, the VIX Cash Term Structure has exhibited distinctive behaviors and patterns prior to major market crashes, allowing astute investors to anticipate and prepare for these tumultuous events.

A prime example is the 2008 financial crisis. Prior to that crisis, the VIX cash term structure showed an upward sloping curve, indicating that short-term volatility expectations were relatively muted compared to long-term concerns. However, as the crisis unfolded, this curve rapidly steepened, indicating heightened immediate fears and uncertainty. Investors who carefully monitored this shift received an early warning of the impending market crash and had the opportunity to recalibrate their portfolios accordingly.

Another historical example is the market crash of 2020 during the onset of the COVID-19 pandemic. The VIX Cash Term Structure experienced an extreme spike, with short-term volatility expectations spiking in contrast to longer-term outlooks. This divergence in volatility expectations was a clear indicator of the abrupt market turbulence that followed.

VIX Cash Term Structure as a Leading Indicator

The VIX Cash Term Structure’s role as a leading indicator underscores its predictive power in anticipating market movements, particularly during periods of heightened uncertainty and the potential for market crashes. This indicator provides insight into market sentiment, and changes in its shape and level often precede broader market trends, making it an invaluable tool for investors seeking early warning signals.

A key aspect of the VIX Cash Term Structure as a leading indicator is its ability to detect shifts in market sentiment before they become apparent through other means. For example, a rapid steepening of the curve, where short-term volatility expectations spike relative to longer-term expectations, can serve as an early warning of imminent market fear. This divergence often indicates that investors are bracing for turbulence, potentially heralding a market downturn.

In addition, the VIX Cash Term Structure’s responsiveness to geopolitical events, economic data releases and other external factors makes it a sensitive gauge of market sentiment. It can react quickly to unforeseen news, providing investors with real-time insight into how the market is perceiving and processing new information.

The VIX Cash Term Structure’s ability to act as a leading indicator is further supported by its track record during past market crashes. A review of historical data reveals that it has often exhibited significant changes in shape and level prior to major market downturns, allowing investors to take precautionary measures or strategically position themselves to navigate these turbulent times.

Incorporating It into Your Investment Strategy

Knowledge is indeed power, but the effectiveness of that knowledge lies in its application. In the following section, we will explore strategies for incorporating the VIX Cash Term Structure into your investment approach. Whether you are looking to protect your wealth or take advantage of market opportunities, this section will guide you through the complex process.

Common Misconceptions (Clarifying Its Limitations and Caveats)

One of the most common misconceptions surrounding the VIX Cash Term Structure is the belief in its infallibility as a crystal ball for market crashes. It is imperative to clarify that while this indicator is a powerful tool for assessing market sentiment and anticipating volatility, it is not a stand-alone panacea. Over-reliance on any single indicator, including the VIX Cash Term Structure, can lead to incomplete insights and missed nuances in the complex world of financial markets. Furthermore, it is crucial to recognize that while the VIX Cash Term Structure provides a sense of market sentiment and potential trends, it does not provide precise timing for market crashes. Market events can be unpredictable and the indicator should be used in conjunction with other analysis and a comprehensive risk management strategy. Understanding these limitations and caveats is essential to realizing the true potential of the VIX Cash Term Structure as a valuable tool in your investment arsenal.

How You Can Benefit From VIX Cash Term Structure

The VIX Cash Term Structure can be a game changer in risk management and strategic decision making. One of the key benefits is its utility in hedging against market downturns. When the VIX Cash Term Structure shows signs of impending volatility or a potential market crash, you have the ability to employ hedging strategies to protect your portfolio. This may include purchasing options or other derivative instruments to offset potential losses. In addition, the indicator can provide insight into shorting specific assets or sectors that are particularly vulnerable to market turbulence. By identifying these opportunities, investors can profit from downward movements in asset prices during turbulent times, potentially mitigating overall portfolio losses.

Conclusion

In conclusion, the VIX Cash Term Structure is not just a complex financial instrument; it is a powerful tool for those seeking to navigate the turbulent waters of the financial markets. By understanding its intricacies, interpreting its cues, and integrating it into your investment strategy, you can gain a valuable edge in identifying potential market crashes before they happen. Use the VIX Cash Term Structure as your early warning system and empower yourself to make informed financial decisions in an ever-changing economic landscape. Whether you’re protecting your wealth or seeking growth, this indicator can be your guiding light in the financial world.