VIX: A Beginner’s Guide

The world of finance and investing is full of jargon and complex indicators. One such indicator that often makes headlines is the VIX, also known as the “Fear Gauge” or “Volatility Index.” For beginners looking to dive into the world of investing, understanding the VIX is a crucial step. In this beginner’s guide, we’ll break down the VIX, explaining what it is, why it matters, and how it can impact your investment decisions.

What is the VIX?

The VIX, or Volatility Index, is a widely used financial benchmark that measures market volatility and investor sentiment, often referred to as the “fear gauge” as it indicates the expected volatility in the stock market over the next 30 days.

Put simply, it measures how much investors think the stock market will fluctuate over the next month. The higher the VIX, the more expected volatility, and vice versa.

Why Does the VIX Matter?

The VIX matters for several reasons:

- Indicator of market sentiment: The VIX serves as a reliable gauge of market sentiment and investor fear. When the VIX rises, it typically indicates heightened market uncertainty and unease about potential downturns. This insight into sentiment can be invaluable to investors seeking to understand prevailing market conditions.

- Risk Management Tool: Investors and traders often turn to the VIX to help them effectively assess and manage risk. By monitoring VIX fluctuations, they can make informed decisions about when to make portfolio adjustments to protect against potential losses. For example, a rapidly rising VIX may prompt a portfolio reallocation to reduce exposure to market volatility.

- Market timing guide: Some astute investors incorporate the VIX into their market timing strategies. For example, a sustained low level of the VIX may signal an opportune time to enter the market, as it implies a lack of fear and complacency. Conversely, a significantly elevated VIX may indicate an appropriate time to consider selling or reducing positions to mitigate risk during turbulent market conditions.

- Diversification Resource: Diversification is a cornerstone of sound investment practices, and the VIX can play a critical role in achieving this. When equities experience heightened volatility, investors can use the VIX as a guide to explore other asset classes, such as bonds or commodities. These assets can potentially provide stability during turbulent market periods, promoting a well-rounded and resilient portfolio.

- Portfolio Optimization: The VIX can help investors optimize their portfolios. By considering VIX data alongside other financial metrics, investors can fine-tune their asset allocation strategies to match their risk tolerance and investment objectives. This approach allows them to create portfolios that are better positioned to weather different market conditions.

Interpreting VIX Levels

Low VIX (Below 20)

- Market Sentiment: A VIX reading below 20 is often seen as a sign of low market fear and complacency. Investors in this scenario tend to be optimistic about the future of the market.

- Investor Behavior: During periods of a low VIX, investors may exhibit confidence in the stability and growth of the market. This can lead to increased buying activity as investors feel comfortable taking on more risk.

Moderate VIX (20-30)

- Market Sentiment: A VIX level between 20 and 30 suggests that some market concerns and uncertainty are present. Investors become more cautious during this phase.

- Investor Behavior: Moderate VIX levels may cause investors to take a more balanced approach. They are likely to pay more attention to economic indicators, corporate earnings reports, and geopolitical events to gauge the market’s direction. When the VIX breaches the 20 level from below, it is generally interpreted as a risk-off scenario. In such situations, investors tend to move out of stocks and other risky assets and instead rebalance their portfolios into safer assets, often considered safe havens, such as bonds.

High VIX (Above 30)

- Market Sentiment: A VIX reading above 30 signifies heightened fear and anxiety in the market. Investors may be bracing for significant market declines or increased volatility.

- Investor Behavior: When the VIX is high, investors often become defensive. They may start reducing their exposure to riskier assets like stocks entirely and move towards safer investments, such as bonds or cash. Additionally, some investors may look for opportunities to hedge their portfolios against futher losses and a complete stock market crash.

Factors Influencing the VIX

Economic Events: Major economic releases have an impact on the VIX, with positive news driving it lower and negative developments driving it higher.

Geopolitical Tensions: International conflicts and crises increase uncertainty and raise the VIX.

Corporate earnings: Earnings reports can cause rapid market movements and affect the VIX.

Federal Reserve Policy: Central bank announcements, especially from the Federal Reserve, affect the VIX.

Market Sentiment: The VIX reflects market sentiment and responds to shifts in fear and optimism.

Monitoring these key factors helps investors anticipate VIX movements and make informed decisions in dynamic markets.

Using the VIX in Your Investment Strategy

Understanding the VIX is an essential foundation, but knowing how to use it effectively in your investment strategy is equally important. Here are some key ways to consider incorporating the VIX into your investment approach:

Risk Management: The VIX can serve as a valuable risk management tool. If you observe a significant upward move in the VIX, it may indicate increased market volatility and potential risks ahead. In such situations, you may want to consider adjusting your portfolio to mitigate risk. This may involve reallocating assets, diversifying your holdings, or even moving to more defensive positions such as bonds or cash equivalents. By monitoring fluctuations in the VIX, you can proactively respond to changing market conditions and protect your investments.

Market Timing: While the VIX provides valuable insight into market sentiment and volatility, it’s important not to base your investment decisions solely on this index. Instead, use it in conjunction with other indicators and comprehensive analysis for a well-rounded perspective. Successful market timing requires a holistic approach that takes into account various factors, including economic data, company fundamentals and geopolitical events. By combining the information provided by the VIX with other relevant data points, you can make more informed and strategic investment decisions.

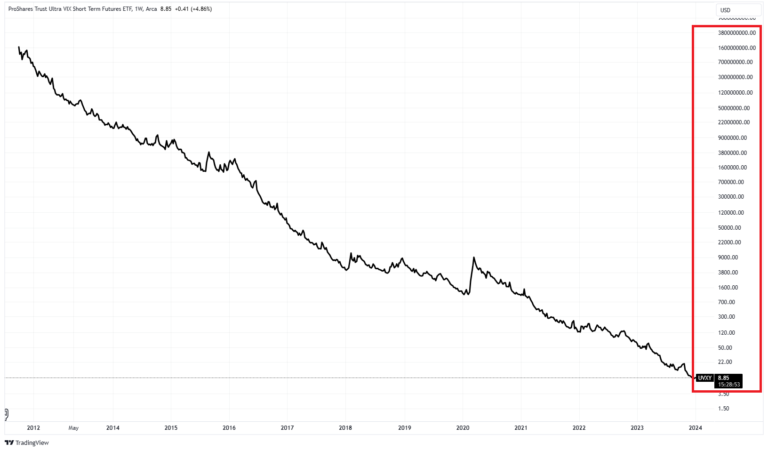

Portfolio hedging: Investors can use VIX-related products, such as VIX futures or options, to hedge their portfolios against market downturns. For example, during periods of heightened volatility or when you anticipate market turbulence, you can purchase VIX options to protect your investments. These options can increase in value as the VIX rises, offsetting potential losses in your portfolio. While hedging with VIX-related instruments can be complex and may require a good understanding of derivatives, it can provide a hedge against unexpected market downturns.

Contrarian Investing: Some investors take a contrarian approach by using the VIX to identify potential market turning points. When the VIX reaches extremely high levels, it often indicates excessive fear and pessimism in the market. Contrarian investors may see this as an opportunity to enter the market or increase their exposure in anticipation of a potential rebound. However, contrarian strategies carry inherent risks, and it’s important to conduct thorough research and analysis before making contrarian investment decisions.

Long-term perspective: While the VIX is valuable for short- to medium-term considerations, it’s important to maintain a long-term perspective in your investment strategy. Market volatility, as indicated by the VIX, can be influenced by short-term events and shifts in sentiment. However, long-term investment success is typically built on a solid foundation of diversified investments, patience, and adherence to your financial goals. The VIX can help you manage short-term volatility, but it shouldn’t overshadow your long-term investment strategy.

In summary, incorporating the VIX into your investment strategy requires a balanced approach that incorporates risk management, market timing, portfolio hedging, contrarian thinking, and a long-term perspective. By using the insights provided by the VIX along with other investment tools, you can enhance your ability to make informed decisions and adapt to changing market conditions. Remember, investment strategies should be consistent with your financial goals, risk tolerance and investment horizon.

Final Thoughts on the VIX

While the VIX may seem daunting at first, it is an important indicator for beginners to understand. It provides valuable insight into market sentiment and volatility, giving investors the knowledge they need to make informed decisions.

Furthermore, the VIX is not the end-all, be-all indicator. It must be viewed in conjunction with other indicators and in comparison to other volatility data such as the VIX.