Stock Replacement

Stock Replacement is a method of using “in the money” Put or Call Options to mimic the directional exposure of a stock or ETF without holding the stock or ETF directly.

Most traders are using stocks or ETFs for their investments. However the replacement through options can be prefered for those who aren´t able to trade ETFs directly or like the slightly altered Risk-Reward profile of this method. Is stock replacement something you should consider, let’s find out.

Who is Stock Replacement for?

Traders who want directional exposure with less capital outlay

Long Put or Call Options are very capital efficient and don’t require a lot of up front buying power. Now it’s true that even when buying ETFs directly, in a margin account they also don’t require the full value. However, long Put and Call Options are even more capital efficient than that. This is especially true if we’re talking about a cash account, such as a tax deferred IRA for example. In that case using Options is far more capital efficient.

If for example you had a strategy or portfolio that does have a viable and safe use for excess capital, then mimicing your ETF positions with Options may free up buying power for whatever else you are planning. You may have a negative correlated Overlay Strategy that would greatly benefit from Stock replacement.

So in essence Stock replacement is first of all well suited for those who want more directional exposure with less captial outlay. Which is one of the main reasons professional and retail traders alike use long Options, besides for hedging porpuses.

People that don’t have direct access to trade ETFs directly

Americans

For some of my fellow Americans it is impossible to trade certain ETFs with ThinkorSwim or the TWS from Interactive Brokers. If it’s not avaiable to you for some reason, then using Stock Replacement will be a viable solution.

Options trading is treated differently and pretty much everybody from any country and any account structure can use long Options. Even withhin tax sheltered accounts like IRA’s, they are still allowed. Stock Replacement uses single leg long Puts or Calls only. There’s no complex spreads and no short positions. It requires Level 1 Options approval only and that’s something everybody should easily be able to get.

Europeans in the European Economic Area (EEA) subject to MiFID II

I have a article on the website which shows you how to buy US based ETFs in the EEA. One of the discribed methods is using Options through buying and execuding them. In that article i go into more detail about the EEA and what the MiFID II rules are, why they are an issue and potential ways to bypass them.

Traders who like the unique Risk-Reward profile

One of the main advantages of using long Options to mimic a position in the underlying is that you have a lower nomial risk in comparrision to owning shares outright. The maximum lose is limited to the premium paid for the option, which is, because of the inherent leverage of an option, much lower.

Eventho the risk is much smaller the potential for profit continues to be theoretially unlimited. If the underlying asset’s prices rises significantly, the call option holder will benefit from the increase in the assets’s value just like the trader that is holding the shares.

Advantages of Stock Replacement through Options

There are both advantages and disadvantages of using Stock Replacement and we’ll cover both next. After i explain how i see this methode you can weigh the pros and cons and decide wether it’s right for you. After that i will show you how to actually do Stock Replacement and give you a few examples and potential situations of usage.

May allow you to trade otherwise restricted products

In my opinion this isn’t the number one advantage to the stock replacement method but it sums up part 1 of this article. There are some people that are eighter because of their account type, their trading permissions or their country of residence not allowed to hold US based ETFs directly.

For those and just for those Stock Replacement is pretty much the only way to trade a number of securities otherswise only accessiable to CFDs, which come with their own shortfalls.

Stock Replacement uses Options contract and therefore bypasses many of those considerations. It allows pretty much everybody to short Volatility or employ other strategies in whatever account type they have. It simply offers additional options for those.

More capital efficient than stocks and ETFs

Holding in the money Options contracts with Stock Replacement method is always going to be far more capital efficient than holding an equal exposure of ETF shares. It involves buying Long only single leg Options which only require enough cash to cover the premium paid. This will mean traders using Stock Replacement will have additional case on the sidelines not being utilized.

In many cases, you will only need to use 40% to 30% of the money you would have used to buy the same directional exposure in the ETF or stock to buy the long option. In some rare cases it could be as little as 20%, although in most cases it will not be efficient.

Having said that i want to stress that Stock replacement is not about about leveraging up and adding more risk to your portfolio. Just because you can choose to do so it’s not the main point of this method.

On the other hand the question of what to do with the additional cash laying around comes up naturally. Especially if your cash amount exceedes the statutory deposit guarantee. In that case and if you want a low risk way to earn a little bit interest on your cash it might be resonalble to allocate that idle cash to very short term Treasury Bonds or an ETF holding them.

In a low return world where the interest rates are near 0% this might have been useless but in times where yields are now over 3% annually it is worth thinking about.

Idle cash could be parked in bonds and it would give a slight long-term performance boost to the strategy. This isn’t a gamechanger but every little improvement accounts exspecially in investing where they can compound and add up over time.

On a side note, this is one of several reasons why hedge funds are performing better in higher interest rate environments than in the very recent past of ultra-low interest rates.

Bild vom iShares Treasury Bond (SHV – currently yielding 3,35%)

Maximum loss is capped to the premium paid for the Options

This is, for me at least, the most important thing about using options as stock replacement. As equity markets go up and volatility goes down over the long term, profit is almost a given, but there are certain scenarios that my portfolio cannot withstand, for which I use stock replacement.

With some trading strategies, the question arises as to what would have happened to them during extreme market movements such as Black Monday of 1987, Volmageddon in 2018 or the Covid Crash of March 2020. The risk of total loss of capital is inherent in all these events and possible future events.

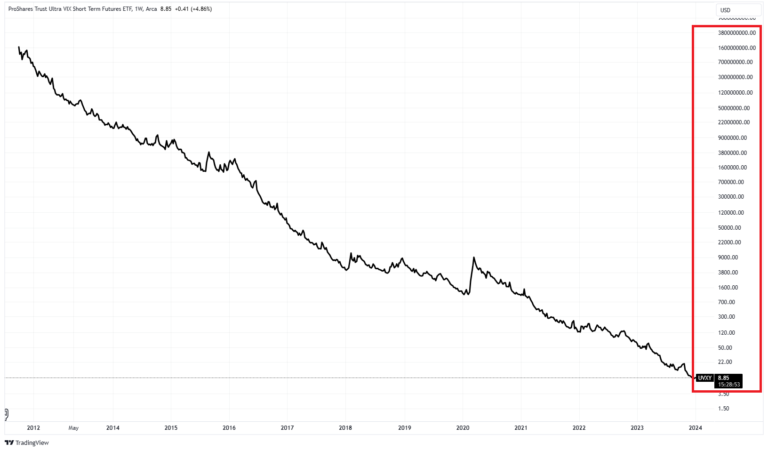

Bild des XIV

For anyone new to the volatility complex, let me remind you that on 5 February 2018, the VIX index rose 115% during the trading session and the VIX futures, which all volatility ETPs hold, came under tremendous pressure and spiked violently. As a result of the after market rebalancing, the old XIV suffered a catastrophic loss of -96% and was terminated. As a result of this event, known in the volatility space as “Volmageddon”, the SVXY was leveraged from -1x to its current leverage of -0.5x.

A trader who held long call options using the Stock Replacement method instead of the direct ETP would have suffered a 30% to 40% drawdown. But they would have survived and lived to fight another day. Not to mention the countless reckless traders who bought XIV or SVXY on average or sold unprotected puts.

While this is an extreme and rare example, it highlights an important rule of investing and trading in general: “Rule #1: Don’t lose money. Rule #2: Never forget rule #1”, it embrasces the maxim of captial protection. And never forget that what has happened can (and will) happen again to the same degree, and you do not want to be the one standing outside in the rain without an umbrella.

The potential for catastrophic losses is a valid fear to use stock replacement rather than buying the underlying securities outright. It protects against total disaster in rare chases, also known as black swan events, and limits the loss to around 20% – 40% of the capital dedicated to the trade.

Custom design your leverage factor through Delta (without exposing yourself to Margincalls and rising Margin requirements)

Those utilizing the stock replacement method are free to selecct the Delta factor that best suits the exposure they are intenting to mimic.

Delta measures the sensitivity of an option’s value to price.

Delta shows how the value of the option will change for a $1 change in the share price. The delta of an option, which ranges from 1 to 0 for calls and -1 to 0 for puts, indicates the potential gain or loss of $0-1 for every $1 change in the share price.

Liquidity of the Options is also extremely important so it’s not advisable to go much higher than 0.7 Delta Options, but that does actually allow for pretty much any leverage factor to be selected.

Although the delta factor is always below 1, meaning that at least 2 options must be bought to get 1x exposure, options contracts are significantly cheaper than holding the underlying ETFs, so the trader will always have enough capital to buy more contracts to increase exposure.

In the same way you can mimic and create your own leverage factor out of any given ETF, just buy buying more or less options. Through a combination of cheaper Options premiums and the ability to custom select the Delta factor, a trader using stock replacement can simulate any exposure level they want on any of the major ETFs.

– Buying two 0.5x delta Options will closely simulate the price action of the underlying.

– Buying two 0.75 delta Options will closely simulate the 1.5x price action of the underyling, e.g. you can simulate an 1.5x leverage S&P 500 ETF buying two 0.75 delta Options on the SPY. All things be equal the position will move just like a 1.5 leveraged S&P 500.

Lose less money during market crashes due to Vega

Another example of the capital protection maxim embodied in the use of the Stock Replacement Method is that traders can expect to lose less money if they are caught in one of these Black Swan events because of the vega, which adds an additional and “free” layer of risk management.

Vega measures the sensitivity of an options value with respect to volatility.

Vega is unbounded and can take positive or negative values, indicating the expected change in the option’s price for a 1% change in implied volatility.

Stock Replacement buys long puts or calls that are vega positive. This means that they have positive volatility exposure, where if volatility spikes, this vega factor will increase the value of the option, helping to offset some of the losses suffered as the price moves against you.

It’s nowhere near enough to make up for the losses on the trade. But it does add a little more downside protection, which always helps. As a rule of thumb, a trader using stock replacement will lose about 5-10% less due to the impact of vega on the option price than someone who owns the underlying directly.

Disadvantages of Stock Replacement through Options

We all know that where there is light, there is shadow. There are always trade-offs with different investment methods, and it’s our job to evaluate them and make a decision. So let’s talk about the drawbacks of stock replacement and how to overcome or reduce them.

Small educational barrier to learn about Options Trading

The fact that you’ve made it this far into this article without being put off by talk of delta, vega and other options jargon suggests that options trading is not new to you. But for the small chance that it is, there is a small barrier to entry.

Since stock replacement uses only single leg long options and not complex option structures like spreads, diagonals, ladders or others, it is very easy to learn with a few hours put into it and some trades to learn it.

Options trading is no more difficult than any other form of investing – it just takes time and practice to get better at it.

We need to overcome the negative effects of Theta

Theta measures the sensitivity of an Options value with respect to time.

Theta, or time decay, indicates how the value of an option will change over the course of a day. It is most pronounced as options approach their expiration date, with the rate of decay accelerating the closer the option gets to expiration.

You don’t need to understand the exact definition, but because the stock replacement uses long options, they are all theta negative trades. This means that they will lose a little each day. Although it is important to understand the basic concept that time decay is not linear across the board. It increases exponentially as the expiration date approaches.

Graphic

The impact of theta increases significantly around 30 days to expiration. So all we need to do is buy options with significantly more time to expiration, so that theta isn’t a big factor and the price of the option is more a factor of the movement of the underlying.

It is optimal to use options with more than 100 days to expiration so that if you spot a longer term trend and want to keep the trade open for a while, you are not forced to switch to an option with more time to expiration every few weeks.

Less efficient during higher Volatility enviroments due to Vega

Vega is a double-edged sword when using options as a stock replacement method. While it can benefit you in times of rising volatility, as I mentioned above, it hurts you if you want to open a position immediately after such a volatility event.

Long Options are a Vega positiv trade. This means they gain value with increases in volatility, and lose value with decreases in volatility. When the market moves in more stable waters and volatility declines as a result the long option will lose a little value.

The solution is quite strate forward: Don’t open long Options during a phase of high volatility.

Unfortunately, this prevents us from using the stock replacement method about 20% of the time. In that case, there’s no way around using other methods to get exposure to the otherwise restricted products, or which I prefer, not trading during those times.

If you really want to trade during these periods of high volatility, there is no easy fix, you have to be willing to accept the vega losses, which means your directional exposure has to be on point.

Liquidity issues can reduce the available securities

Liquidity isn’t such a big deal these days, but I’ll mention it shortly. Unlike equities or ETFs, not every options market is robust enough to trade. There are some niche products, such as SVXY, that suffer from a less than liquid options market, resulting in high spreads, especially on longer-dated options, also known as LEAPS options.

Fortunately, there are plenty of subsitues like VXX that have a different leverage factor and position bias (VXX is long volatility, SVXY is short volatility), but that’s not really a problem as you can buy a long put in VXX to mimic a long call on SVXY.

Missing out on potential dividend payments

Using stock replacement to mimic a position in an equity ETF has its own problems. One of them is that you miss out on the dividend payments that you would have saved if you had bought the shares.

One way to counteract this is to put the extra money into a bond ETF, as I have shown above, but it still remains a drawback of this method.

Limited Time Horizon and the need for active Management

Stock replacement is a method of active portfolio management. It requires, because of the expiration of the used options, active management and constant monitoring.

You don’t have to sit in front of your PC all day, but it is much more time consuming than buying and holding the underlying. It’s not a consideration for me as my strategy still requires a daily review, but it is an issue for some traders.

Higher Transaction costs

It goes without saying that the more frequent you trade the higher the transaction cost (spread + fees) will be. Even in the days of zero-fee brokerage accounts even small cost can add up.

Taxes and tax problems

There is no trading or investing without Uncle Sam opening his hands and demanding his cut. As every jurisdiction is different, I will not delve into this topic, but it is something to keep in mind.

Changes day to day

Every option trader knows that the simulated exposure of options vary all the time. Delta, Vega, Theta, the movement of the underlying and all the other option greeks change by the minute and so does your exposure.

Sometimes they counteract each other, sometimes they reinforce each other. In short, options are all complex, even a simple long option can be, but in most cases the changes are so miniqure that if you have done everything right, 100+ to expiration, voiding high volatility environments, you wont notice the ever changing nature of the long option.

How to do Stock Replacement

Basically, it is very easy to do a stock replacement. It may take a little thought at first, but with time and enough trades under your belt, it will become second nature.

Replacing a position in the underlying with options requires a three-step process. First you calculate the muliplier, than you select the strike price and after that you can calculate the number of contracts needed.

Let’s say you want to allocate $10,000 to a short volatility position using VXX.

Calculate the Multiplier for the Allocation

First, you need to calculate the multiplier for your share replacement. This is done by taking the current price of the underlying and multiplying it by 100 – one option represents 100 shares of the underlying – to get the muliplier.

In this example the VXX is trading at 26.12 which means the multiplier is: 26.12 * 100 = 2,612.

Strike price selection

Since we want to minimise the impact of theta we want to choose a option with more than 100 days to expiraction. In that option string we want to select a delta between 0.5 to 0.8.

Which one you choose is a matter of discretion, there is no clear right or wrong here, just pick one with enough liquidity and lots of open interest and you should be good to go. In most cases, the round strikes like those ending with five or zero are the most liquid.

Calculate the number of contracts

In the next step, we take the amount we want to bet on this position, divide it by the delta factor we have chosen, and divide it by the multiplier we calculated in the first step to get the number of contracts we need as a result.

(Allocation / Delta) / Multiplier: (10,000/0.5) / 2,612 = 7.66

Now you can choose whether you want to buy seven or eight put option contracts on VXX, which is a completely subjective decision based on your risk tolerance.

Optional is the custom leverage factor

Perhaps you don’t want to take such an aggressive approach to shorting volatility and want to mimic the movement of SVXY using VXX put options. Since SVXY has a leverage factor of 0.5x and VXX has a leverage factor of 1x, you need to take this into account.

The easiest way to choose a custom leverage factor is to change the amount of capital you want to allocate to the position.

In this example you would halve the allocation to this trade to account for the half leverage of SVXY vs. VXX.

Number of contracts required = ((Allocation/Delta)/2)/Multiplier: ((5,000/0.5)/2)/ 2,612 = 1.91

For those who have been paying attention, we have already chosen our custom leverage factor. When we decided whether to buy seven or eight put options one step above, we chose a custom leverage factor.

Leverage factor = (# of contracts * Multiplier) / (Allocation/Delta)

Leverage factor with 3 long put options = (7*2,612)/(10,000/0.5)= 0.9142

Leverage factor with 4 long put options = (8*2,612)/(10,000/0.5)= 1.0448

In choosing eighter seven or eight long put options on VXX with a delta of 0.5 you are eighter simulating a 0.91x or 1.04x VXX short position.

Conclusion

In conclusion, stock replacement using in-the-money put or call options is a versatile strategy for traders seeking directional exposure with improved capital efficiency and a unique risk/reward profile. This method is suitable for those with limited capital, those with restrictions on direct trading of certain ETFs and those who appreciate the risk mitigation aspects of options.

The benefits of equity replacement include the potential to trade otherwise restricted products, increased capital efficiency compared to equities and ETFs, a capped maximum loss, the ability to customise leverage through delta and potential resilience in market crashes through vega. However, it is important to be aware of the drawbacks, such as the need for active management, potential tax implications and the impact of Theta and Vega.

Ultimately, stock replacement is a dynamic strategy that offers flexibility and risk management benefits. Traders considering this approach should carefully weigh the pros and cons, tailor it to their risk tolerance and objectives, and actively manage their positions to navigate the ever-changing landscape of options trading.

In one sentence: Stock replacement offers risk management and fine-tuning potential with the trade-off of added complexity.