How High Can The VIX Go?

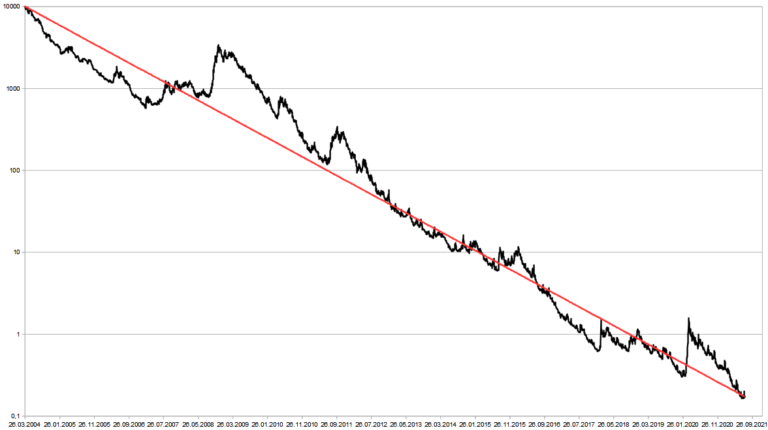

In the last marketcrash during march 2020 i asked myself how high can the VIX go? The VIX nearly trippeld from the lows to 50 and the S&P 500 already dropped 20%. I saw that fear and panic pushed stocks down and the vix up but i did not know if it could get worse. Is there a upper limit the VIX cannot go over and when signials the VIX to look for buying oppertunities in stocks? This post will hopefully help.

The VIX has no upper limit and he could theoreticly rise well above 100. However during past market crashes the VIX went up to a high of 80 before declining. On Black Monday in October 1987 when the S&P 500 dropped a fourth, volatility reached an intraday high of 172,79.

Today we have circuit breakers that make it hard to think about the VIX going higher than that. Since the VIX reflects the fear of market participants it can be very profitable to buy when others are at the peak of panic.

What does the VIX Measures

The VIX measures the implied volatility of the S&P 500. Since implied volatility is a measurement of the market’s expectations for future price changes, it has no limit. Fear and panic can drive investors and traders to expect extreme price fluctuations, leading to a spike in the VIX.

The value of the VIX represents the market’s expectation of how much the S&P 500 will likely move within the next 30 calendar days, not a year, which is equivalent to approximately 252 trading days. A VIX over 100 implies a potential S&P 500 price move of over 100% in either direction. However, it’s important to note that since the S&P 500 cannot decline below 0, a VIX value over 100 is technically possible but not typically expected in the realm of common sense.

Extreme emotions, driven by the VIX, are often short-lived and dissipate as quickly as they arise. Therefore, the VIX cannot remain at extreme highs for long. Values over 70 persist no longer than days, maybe weeks at a time.

What causes extrem VIX highs

VIX spikes aren’t as uncommon as people think. Every few years, the VIX rises into the 40 to 50 range, marking phases of deep uncertainty and expectations of huge price swings, either positive or negative. Extremely high VIX levels are very unusual and happen only once a decade.

The cause for VIX values exceeding 50 is a shift in market psychology. People’s fear accelerates into panic. Justified and unjustified concerns become mixed up, exaggerated, and escalate into financial existential angst, driving the index to extreme levels.

Triggers of VIX values over 50 are two out of three times a major global events effecting every economie around the world. While one time it was the result out of “technical” reasons such as rising interest rates and overvalued stocks.

Historical exampels of Highs in the VIX

Throughout history, there have been several instances of exceptionally high VIX levels, such as during the 2008 financial crisis and the COVID-19 pandemic in 2020. These episodes serve as valuable case studies for understanding how the market reacts to extreme uncertainty and fear.

The How to profit from extreme high VIX

Since the VIX reflects the fear of market participants, it can present profitable buying opportunities when others are gripped by panic. When the VIX surges, it often indicates that investors and traders expect significant price fluctuations in the near future. These fluctuations can go in either direction—up or down. It’s during these periods of heightened uncertainty and fear that savvy investors may consider buying assets, such as stocks, at discounted prices.

Profiting from extreme high VIX levels requires careful consideration and risk management. While it can be an opportunity to buy assets at lower prices, it’s essential to remember that volatility can persist, and markets can remain turbulent for an extended period. Diversification and a well-thought-out investment strategy are crucial for navigating such conditions.

Risks of a high VIX

A high VIX reflects a market in turmoil, and with that turmoil comes increased risk. Sharp and unpredictable price swings can lead to substantial losses if not managed effectively. Investors should be cautious and ensure they have a clear plan in place when dealing with a high VIX environment.

A high VIX serves as a clear barometer of a market in turmoil, signaling a landscape characterized by heightened uncertainty, anxiety, and erratic behavior among investors. In such conditions, risks become more pronounced, and the potential for sharp and unpredictable price swings looms large. These sudden fluctuations can lead to substantial financial losses if investors fail to navigate the turbulent waters with prudence and foresight. It’s imperative for investors to exercise caution when the VIX is elevated and to have a well-defined strategy firmly in place. Without a clear plan to guide their decisions, individuals may succumb to impulsive actions driven by fear or greed, ultimately exposing themselves to greater vulnerabilities in an already precarious environment.

Therefore, in the face of a high VIX, a structured and disciplined approach to investment is not just advisable; it is often the key to preserving capital and potentially capitalizing on opportunities that arise amidst the chaos.

Data and Statisik

In the realm of financial markets and the VIX, the role of data and statistics cannot be overstated. These quantitative tools provide invaluable insights into market trends, historical patterns, and potential future movements. By analyzing relevant economic indicators, earnings reports, and geopolitical events, investors can gain a clearer understanding of market sentiment and its impact on the VIX.

Additionally, statistical analysis can help identify correlations and patterns that may assist in making informed investment decisions. Whether it’s tracking historical VIX levels during market crises or using statistical models to predict potential market movements, data and statistics are fundamental tools for investors seeking to navigate the complexities of the financial world.

Conclusion

In conclusion, the VIX, or Volatility Index, is a powerful indicator of market sentiment and turbulence. While it has no fixed upper limit and can theoretically rise well above 100, historical data has shown that during past market crashes, it typically peaked around 80. Extraordinary events, like Black Monday in 1987, have seen the VIX reach unprecedented levels, but today’s market mechanisms, such as circuit breakers, make such extreme scenarios less likely.

Understanding the VIX’s role in measuring implied volatility of the S&P 500 is crucial. It reflects the market’s expectations for future price changes, and when it surges, it signifies anticipations of significant price swings ahead. This can create opportunities for investors, as extreme emotions, driven by the VIX, are often short-lived.

However, with these opportunities come heightened risks. A high VIX reflects a market in turmoil, where sharp and unpredictable price swings can lead to substantial losses if not managed effectively. Having a clear and well-thought-out investment plan in place is paramount during such turbulent times. Investors should approach the high VIX environment with caution and discipline.

While the VIX can offer insights and opportunities, it’s essential to remember that it’s just one piece of the puzzle. Data, statistics, and thorough analysis are necessary to make informed decisions in a high VIX environment.

In the end, navigating the complexities of the financial markets, especially during periods of extreme volatility, requires a balanced approach that combines a deep understanding of market dynamics with a robust investment strategy.