Today, we embark on an exploration of the second panic point, illuminating the fascinating world of volatility embodied by the VVIX index.

Created by the Chicago Board Options Exchange (CBOE), the VVIX is the focus of our journey. This synthetic index provides a snapshot of market fear and volatility, offering a unique perspective on the current state of the S&P 500. But why should traders pay attention, and how can understanding the VVIX improve one’s ability to navigate the unpredictable stock market?

The relevance of the VVIX becomes clear when we unravel the complexity of volatility within volatility. Think of it as a lens that provides insight into the complex world of options trading, which directly influences the VVIX.

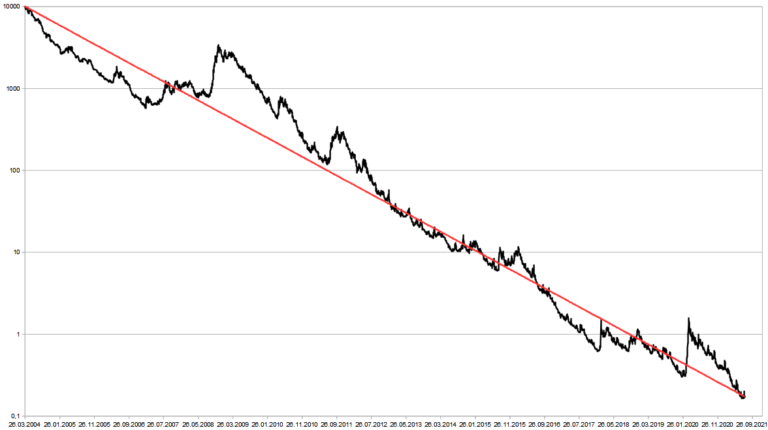

The distinguishing feature that elevates the VVIX is its ability to detect panic in the market. A historical excursion will guide us through instances when the VVIX has exceeded 140, a rarity that serves as a clarion call for options sellers. To deepen our understanding, a detailed case study from March 2020 will be examined, highlighting the real-world implications of the VVIX during market panics.

Beyond numerical indices, this endeavor aims to provide a practical understanding of market behavior: spot the panic of others and profit from it. The VVIX plays a pivotal role in identifying selling panic, market bottoms, and is therefore a great panic indicator.

The Basics of VVIX

You see, the VVIX is not just a random number; it’s a synthetic index created by the Chicago Board Options Exchange (CBOE) specifically to measure the level of fear and volatility in the S&P 500.

To grasp the essence of the VVIX, it’s important to understand that it unravels the complexity of volatility within volatility. In essence, it provides us with a snapshot – a momentary freeze-frame – of the prevailing fear and volatility in the S&P 500. Think of it as a dynamic indicator, a reflection of market sentiment at any given time.

In this article, I explained the VVIX, its correlation to the S&P 500, and how to use it as a panic signal.

But at its core, the VVIX is like a heartbeat monitor for market sentiment. It encapsulates the implied volatilities of the S&P 500 Index, providing a nuanced understanding of how much fear is currently embedded in the stock market. It’s not about predicting the future; it’s about interpreting the present – taking the temperature of the market, if you will.

Detecting Panic in the Market

Let’s now delve into a crucial aspect – detecting panic in the market using the VVIX.

Imagine this: the VVIX exceeds 140. Why is this significant? Well, it’s a rare occurrence, and when it happens, it’s akin to the market sounding an alarm. This isn’t your everyday fluctuation; this is a signal, a red flag, indicating heightened fear, uncertainty and panic.

Our journey into historical events reveals the true power of the VVIX. Take March 18, 2020, for example – a day marked by significant market panic. The VVIX spiked above 200, a level rarely seen. Now, this isn’t just a number spiking on a chart; it’s a wake-up call for options sellers. It’s the market screaming, “Look out, something big is happening!”

So why should you care? Because recognizing panic signals is like having a crystal ball in the trading world. When the VVIX crosses 140 or, in extreme cases, 200, it’s not just about the number; it’s telling us that others are in panic mode, selling at all prices and buying options at a large premium.

Remember, recognizing panic is not about giving in to fear; it’s about staying informed. When the VVIX speaks, it’s our responsibility to listen and act. So the next time you see this number rise, especially above 140, recognize it for what it is – a signal in the noise.

Daily monioring of Panic Signs

Now let’s talk about the importance of daily monitoring and our subsequent reaction to the VVIX. Daily monitoring may sound like a tedious routine, but trust me, it’s a strategic move that can make a world of difference in your trading efforts.

I’ll be honest, I don’t monitor the VVIX every day. I reserve my focused attention for those truly tumultuous market moves. However, incorporating the VVIX into your daily routine, especially during significant market shifts, is a prudent practice.

Why, you ask? Because it’s all about developing a market sensibility. Think of it as tuning your instincts to the rhythm of the market. By watching the VVIX daily, even briefly, you begin to notice patterns and anomalies. It becomes part of your trading routine, an essential aspect of staying ahead of the game.

So why is it important in the grand scheme of things? The VVIX is our ally in understanding panic signals. In rising markets, volatility may remain subdued and the VVIX won’t necessarily spike. However, in falling markets, especially during significant downturns, the VVIX can be the early warning system we desperately need.

So here’s the drill – daily monitoring isn’t just about checking a box; it’s about staying attuned to the heartbeat of the market. When you see the number on the VVIX rise, even if it’s just a bit above its usual range, it’s a cue to pay closer attention. It’s your signal to get ready for potential market turbulence.

Remember, daily monitoring isn’t about micromanaging your trades; it’s about being proactive and informed. By making the VVIX part of your daily routine, you’re not just looking at numbers on a screen – you’re deciphering the language of the market and preparing for whatever the financial landscape throws your way.

Summary

In conclusion, we’ve traversed the fascinating realm of the VVIX index and unraveled its importance in understanding market panic. The VVIX isn’t just a number; it’s a powerful tool created by the Chicago Board Options Exchange that gives us insight into the ebb and flow of fear and volatility within the S&P 500.

As we’ve learned, identifying panic in the market is a skill that goes beyond mere numbers. When the VVIX exceeds 140 or, in rare cases, 200, it serves as a red flag – a signal that demands our attention. Historical events, such as the notable day on March 18, 2020, when the VVIX spiked above 200 during a market panic, underscore the real-world implications of this index.

By incorporating the VVIX into our daily routine, we develop a nuanced understanding of market behavior, allowing us to proactively respond to potential turbulence.

If you find this helpful, you may also be interested in other signs of market panic. In this article you will find 4 more panic signals like this one.