VVIX Demystified: Navigating the Volatile Terrain

In today’s ever-evolving financial landscape, it’s crucial to grasp the intricacies of indicators that can potentially unlock opportunities for savvy investors. One such indicator that holds the key to understanding market dynamics is the VVIX. Have you ever wondered how this enigmatic sibling of VIX, the fear gauge, could be your secret weapon in navigating the volatile terrain of financial markets? Buckle up, because we’re about to demystify the VVIX and reveal how it can empower you to make those informed, strategic moves that could be your ticket to financial growth.

Now, picture this: you, armed with a newfound understanding of VVIX, confidently making investment decisions that have the potential to boost your portfolio’s performance. Imagine having an edge in a world where markets can swing like a pendulum, and knowing when to seize those opportunities that others might miss. Curious to learn more?

Decoding the VVIX

The VVIX Index, one among the myriad volatility indices released by the Chicago Board of Option Exchange (Cboe), offers a unique glimpse into the expectations of future volatility shifts. This seemingly cryptic number has the power to act as both a reversal indicator and an early harbinger of trend changes. For those navigating the treacherous waters of stocks, ETFs, and volatility trading, the VVIX can become an invaluable ally.

Harnessing the VVIX: A Financial Alchemy

Depending on your investment and trading strategy, the VVIX can be harnessed in diverse ways. Regardless of its specific trading applications, certain fundamental insights about the VVIX are worth noting. After conducting a statistical analysis of historical data, the VVIX can be utilized in two primary ways:

Fundamental Insights into VVIX

The pure VVIX Index stand: When the VVIX soars, it signals heightened market uncertainty, while lower VVIX levels suggest a certain degree of market confidence. The interpretation of the VVIX index is simplified into key levels:

- Extrem High: VVIX > 140

- High: VVIX > 105

- Normal: VVIX between 80 and 105

- Low: VVIX < 80

Once the VVIX crosses the threshold of approximately 105, it signifies a market prone to significant fluctuations. In contrast, VVIX values between 80 and 115 fall within the “normal” range, and historically, values below 80 indicate a particularly low market sentiment.

Behavior of the VVIX: The VVIX’s movements are characterized by two distinct features – the abruptness of its rises and falls, and the magnitude and speed of upward spikes. This behavior mirrors that of other volatility indices and reflects the swift and sudden shifts in investor sentiment from optimism to despair and vice versa.

This pattern was particularly evident in the events of 2020:

Statistical Analysis of the VVIX

Irrespective of how you intend to use the VVIX Index for trading, having a precise understanding of it is paramount. To draw reliable conclusions for your investment behavior, a solid foundation is essential. This foundation is achieved through a statistical analysis of the VVIX’s historical index values.

The results of this analysis are as follows:

Lowest Value: 59.74

Bottom 1 Percent: 65.43

Bottom Quarter: 81.67

Mode*: 84

Median: 90.19

Average: 93

Top Quarter: 101.85

Top 1 Percent: 143.17

Highest Value: 207.59

(*rounded to the nearest whole number)

The VVIX is distinctive in its tendency to swiftly return to “normal” values after brief, sharp spikes. The typical VVIX range lies between 80 and 95, where the VVIX spends 40% of its time. Within this range, the mode of VVIX stands at 84, the average at 93, and the median at 90.

By categorizing historical VVIX data into quintiles, we can illustrate its behavior, highlighting periods of relative stability and brief surges.

0 to 0.2 = VVIX between 60 and 80

0.2 to 0.4 = VVIX between 80 and 85

0.4 to 0.6 = VVIX between 85 and 95

0.6 to 0.8 = VVIX between 95 and 105

0.8 to 1 = VVIX between 105 and 210

The VVIX as a Reversal Indicator

With a solid data foundation and a deep understanding of VVIX behavior, we can now explore its utility in trading. One of the most prevalent uses is employing the VVIX as a reversal indicator – buying when the VVIX surpasses a certain threshold.

For example: When the VVIX crosses 130, I take action…

The underlying investment thesis here posits that when there’s a significant demand for hedging, and market participants are particularly uncertain about future volatility, it’s a sign that stock market lows and volatility peaks may be on the horizon.

In essence, the strategy boils down to buying ETFs and stocks while shorting volatility when the VVIX is exceptionally high. This approach stems from a thorough analysis of historical data. Statistically, the VVIX spends only a brief time above a certain threshold, such as 130 or 140 (101 times above 130; 47 times above 140 since 2007). Given its high correlation and negative beta to the S&P500, the VVIX serves as a reliable contrarian signal for the stock market and volatility.

Following this approach, traders would initiate trades upon exceeding the threshold, aiming to profit from a rising market and a decrease in volatility.

However, using the VVIX as a reversal indicator comes with the risk that the market may continue to decline and volatility could rise further. Just because the VVIX rarely surpasses a specific threshold doesn’t mean it can’t climb higher or that the market must immediately reverse.

Detecting Trend Breaks with the VVIX

The second method of using the VVIX for trading is as an indicator for identifying trend breaks. In this approach, you define a range within which the VVIX typically operates and establish trading actions based on its departure from that range.

For example: If the VVIX exits the range of 90 to 105, I take action…

The underlying concept here is that during rising stock markets, there’s less uncertainty and less need for hedging, and extreme fluctuations or an increase in volatility aren’t expected. However, if the VVIX breaks out of this range, it signals a potential rupture in the prevailing trend.

In summary, when the VVIX exits its range, the current trend may be broken.

This approach is also rooted in historical data analysis, observing that the VVIX tends to remain within a certain range during upward-trending stock markets. If the VVIX exits this range, it could indicate that the stock market is in the process of declining or could fall further.

By following this approach, traders would close their existing positions and potentially open new ones, such as hedging, when the VVIX breaks out of its range.

When using the VVIX to detect trend breaks, there’s a risk of either exiting a trend prematurely or, if the range is too broad, exiting a trend long after it has ended.

Conclusion on how to use the VVIX

The VVIX can serve as both a reversal indicator and a trend break indicator, but it should be considered as one of several factors in your trading decision-making process. The choice depends on your investor type, whether you’re a trend follower or a contrarian.

Given the typical behavior of the VVIX, it’s essential to monitor it on a daily basis if you intend to use it for trading. Whether you use it based on closing prices, as demonstrated here, or even intraday, depends on your trading style. The VVIX is most suitable for highly active investors andtraders.

VVIX Correlation with the SPX

To utilize the VVIX as an indicator for stock market movements, we need to examine its correlation with the S&P500. The correlation coefficient should ideally be close to 1 or, in the case of the VVIX, close to -1.

The historical correlation between the S&P500 and the VVIX stands at -0.4841. In essence, the VVIX tends to decline when the S&P500 rises and vice versa. This confirms the fundamental assumption that rising stock markets correlate with reduced demand for hedging and that falling prices lead to an expansion of expected volatility.

The VVIX to VIX Ratio

In the American financial realm, the ratio of VVIX to VIX serves as a popular reversal indicator.

To obtain the VVIX-to-VIX ratio, you divide the closing prices of the VVIX by those of the VIX. According to widespread belief, a ratio of less than 3.5 from VVIX to VIX signals capitulation in the financial markets. When this ratio is breached, in anticipation of a bottoming out, ETFs, stocks, and other products should be purchased.

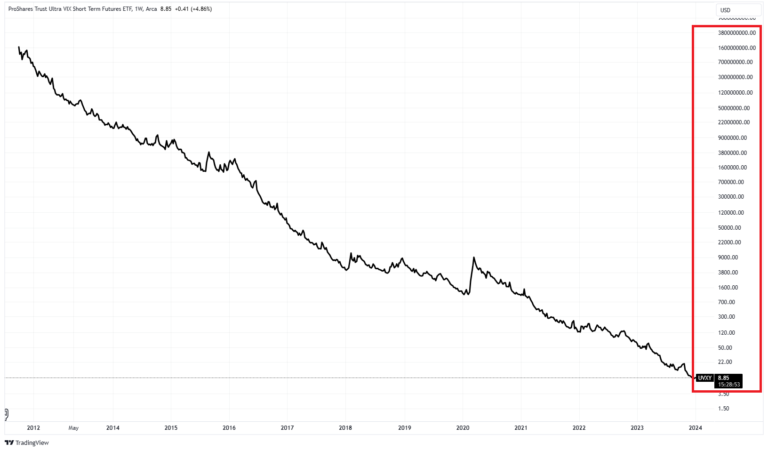

Tradable products for use with the VVIX

The VVIX itself cannot be traded; it serves solely as an indicator to trade other products. The most immediate candidates are VIX futures and their options, to which the VVIX directly pertains. In the realm of volatility, products like VXX, UVXY, and SVXY, which are based on VIX futures, can be traded with the assistance of the VVIX.

Furthermore, due to its negative correlation with the S&P500, the VVIX can be employed as a signal generator for trading ETFs, individual stocks, and options on these assets.

Calculation of the VVIX (White Paper)

For the computation of the VVIX, the Cboe utilizes options on VIX futures. The foundation involves creating a hypothetical VIX future with a 30-day maturity. This is achieved by weighting the nearest-to-expire and second nearest-to-expire VIX futures in a manner that results in an average maturity of 30 days. The methodology resembles the calculation of the VIX.

Options on the remaining VIX futures with longer maturities are not considered in the VVIX calculation.

This systematic approach aligns with the VIX and includes both “Out-Of-The-Money” and “At-The-Money” options in its computation.

In the world of finance, subtle knowledge is often the key to unlocking significant gains. As you delve into the enigmatic realm of the VVIX, remember that it is but one piece of the puzzle. Combine its insights with other tools, strategies, and your own judgment to navigate the financial markets with finesse and, potentially, reap substantial rewards.